Our vision.

Any market is a sum of its participants, and the equity market is no exception. Whether they are big investors like pension funds or small retail investors, all participants buy and sell using their own ideas and methods.

Some investors may be targeting dividend payments. Others look for small companies that have good growth perspectives. All these opinions come together to form the market’s opinion, which in turn determines the movements of prices.

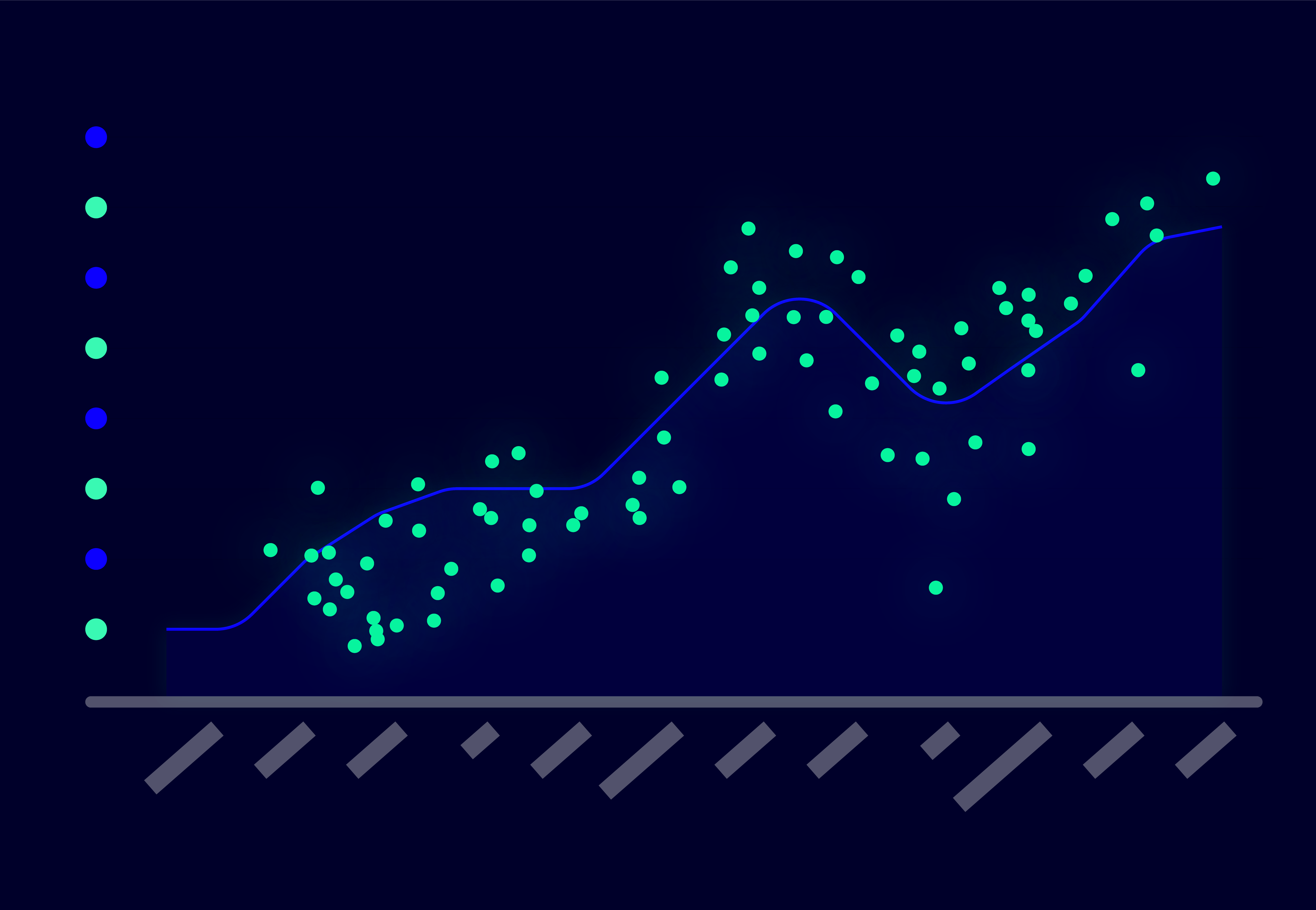

Our algorithm aims to model and then predict the average opinion of the market. By analysing what market participants consider important, we try to predict which features are important and how they are valued at a certain point in time. This allows us to model relative stock attractiveness.

Aggregating and estimating the market’s considerations takes a careful approach to managing data.

Our pillars of success.

Data extraction

Our data comes from multiple different sources and is all stored in our cloud environment. This data is diverse and ranges from price data to fundamental information about companies, and from analyst forecasts to overall sentiment. Anything that can influence an investment decision can also influence the market, and can therefore improve our forecast.

Data due diligence

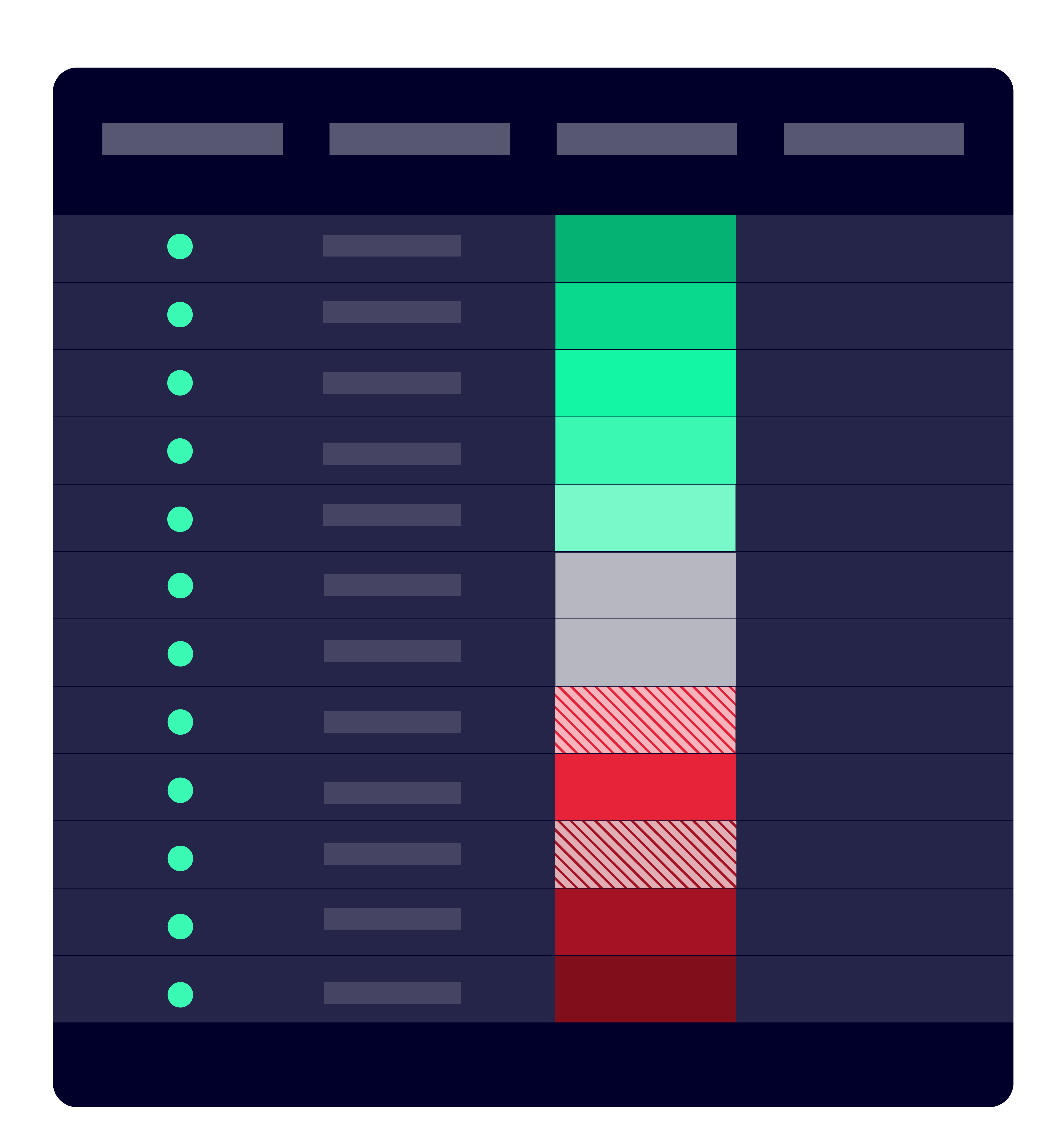

A computer’s output can only be as accurate as the information entered into it, hence we have to make sure the data is trustworthy and interpretable. There are many situations in which data can be faulty or not behaving as expected. That’s why we continuously review our data for any anomalies.

Data enrichment

Raw data can be difficult to interpret and, therefore, needs to be processed correctly to measure its importance and possible impact. An example would be calculating financial ratios from a company’s balance sheets. Using cloud computing, these calculations can be made faster and more scalable, keeping any delay to a minimum.

Data analysis

Once all data is in the right place, we apply our algorithm to model the markets and make predictions. With this we make our investment decisions. It processes the latest data to make a new prediction about which company features the market values most.

Our technology.

Systematic

As a systematic investment manager, we believe that human input can have a negative influence on investment decisions. During times of stress or crisis, when it is difficult to keep an objective view, market participants might unconsciously make decisions that hurt them in the long term. These subjective decisions can have an impact on their profitability, exposure, and risk.

We eliminate this bias by using a structured, systematic approach. Our approach means we can capitalise on chances that appear in the market, regardless of any short-term tension or uncertainty. Data guides all of our decisions, making them more objective no matter the climate.

Cloud

We’ve set up an efficient and reliable cloud infrastructure, because we believe that flexible data storage is a must for a fund like ours. There are 4 main advantages to the use of a cloud-based infrastructure: first, it keeps costs low, as we can use only the storage we need at any given time. This also means that we can add or remove data sources as we see fit and scale up or down in an instant, because storage capacity is never a problem.

Another benefit is security: the cloud provider will ensure that our storage is always up to date with the latest technology and security. And the last benefit is that we can test new strategies risk-free whenever we need to.

As you can see above, the scalability from our cloud-based infrastructure lets us react quickly to new developments, and innovate at a faster pace than ever before.

Machine learning

Another innovation that helps us eliminate bias and make better decisions, is machine learning. Academic innovations have brought forward a wide range of technology and methods that can learn independent of human input. This means that our algorithm can learn from historical data and improve itself over time. This is a powerful tool and one that gives us an edge in a highly competitive market.